As we move through 2023, the possibility of a recession is at the forefront of most investors’ minds. Fortunately, most municipalities are in a good starting place for a downturn. Tax revenue has soared recently, and federal aid has also helped to boost the balance sheet of state and local governments. Many issuers have reported record-high budget surpluses and/or all-time high reserve levels. Municipal bond defaults have been very low at only 0.04% in 2022, down by over 21% from 2021 levels according to Bloomberg data. Further, municipalities generally have weathered economic downturns very well, largely due to resilient tax revenues. Chart 1

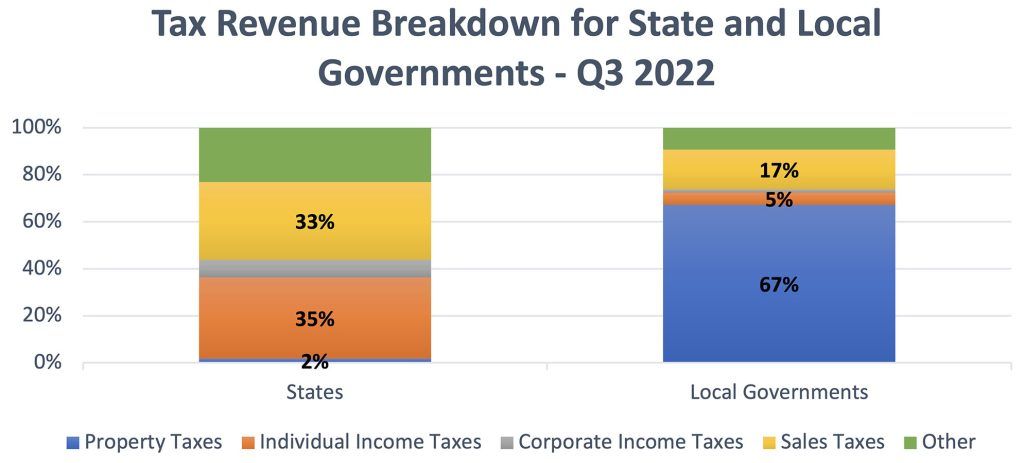

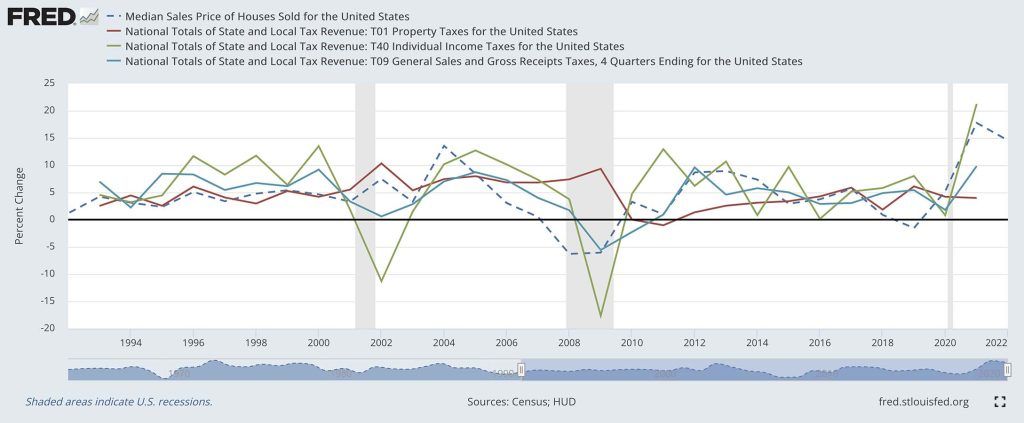

Most local governments rely heavily on ad valorem, or property, tax revenue as shown in the chart above. Property tax revenue rarely declines on a broad basis, but when it does, it tends to lag the economy. Federal Reserve Economic Data (FRED) reveals that while median home sales prices fell by over 6% in 2008 and 2009, property tax revenue increased at the same time, was flat in 2010, and fell by only about 1% in 2011 before it continued a positive trajectory. This is the only time total property tax revenue has declined since at least 1992. Given the recent boom in home prices, it is unlikely that assessed valuations would decline if we encountered a mild recession in 2023. Chart 2

Sales tax revenues, the second largest source of tax revenue for both state and local governments, also declined for the only time since 1992, during the Great Recession: 5.6% in 2009 and 2.3% in 2010. Sales tax revenue experienced a slowing of the growth rate, but not a decline, during the 2001 and 2002 recessions. However, income tax revenues, a major revenue source for state governments but not usually local governments, are highly correlated with economic activity. In two of the last three recessions, aggregate income tax revenues declined significantly: 11.3% in 2002 and 17.6% in 2009. Despite these declines, state revenues recovered quickly and have since grown tremendously.

On the other hand, economic downturns can worsen existing credit issues and impair elastic revenue streams. Moody’s reports that the frequency of municipal bond defaults increased during and after the Great Recession, with an average of five new issuer defaults per year from 2008–2017 compared to an average of two new defaults per year over the past 50 years. According to Moody’s, there were 38 defaults from 2008–2017, excluding Puerto Rico. From 2018–2021, there has been only one default of a Moody’s-rated issuer. However, when expanding the view to include both rated and non-rated issuers, there were 57 issuers that defaulted in 2021 and 52 issuers in 2022, according to Bloomberg. This demonstrates the additional risk associated with non-rated municipal bonds, with most of those defaults in the healthcare and development sectors.

In fact, healthcare and development bonds together have accounted for more than 70% of all municipal bond defaults each year since 2018. Issuers without tax support in the healthcare sector have had a volatile few years since the beginning of the pandemic. Margins have been pressured further by inflation and high labor costs amid a nursing shortage.

Credit quality of development districts can vary widely depending on location and primary revenue sources. In some areas, commercial real estate values are depressed as the “work-from-home,” or hybrid work models, weaken demand for office space. Also, bonds issued by Tax Increment Financing (TIF) districts or other development districts may be repaid from a narrow, economically sensitive revenue stream. For example, TIF bonds are usually secured by a tax on an increase in the assessed valuation of that district following a project or improvement. If the value of that area remains flat or declines, revenues may not be sufficient to repay the bonds as planned. In other cases, development bonds may be secured by a tax derived from sales in a specific area, which could be disproportionately affected by an economic downturn depending on the types of businesses in the district.

While past performance is no guarantee of future results, most municipalities are well-prepared for a downturn and may not even see much, if any, decline in tax revenues. However, idiosyncratic risks remain particularly within the healthcare and development sectors, and other weak credits may be further impaired by a recession. Investors should cautiously monitor holdings of these types of bonds, particularly if they are non-rated and don’t carry any additional bondholder protection.

Dana Sparkman, CFA, is Senior Vice President/Municipal Analyst in The Baker Group’s Financial Strategies Group. She manages a municipal credit database that covers more than 150,000 municipal bonds, providing clients with specific credit metrics essential in assessing municipal credit. Dana earned a bachelor’s degree in finance from the University of Central Oklahoma as well as the Chartered Financial Analyst designation. Contact: 405-415-7223 or dana@GoBaker.com.