The use of AI technologies in financial institutions can drastically reduce operational costs while significantly increasing productivity.

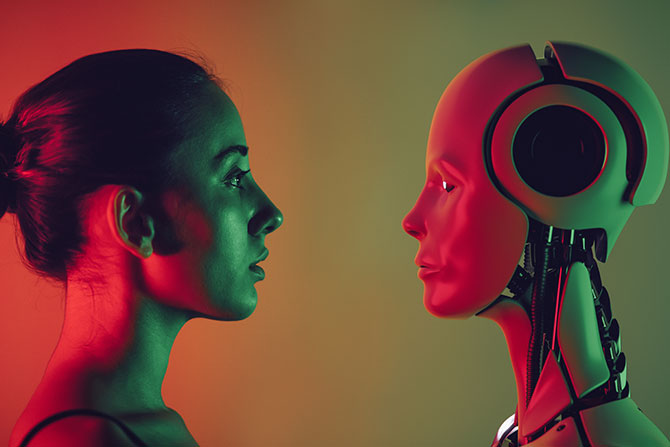

The technologies of artificial intelligence (AI) are becoming an integral piece of the world we live in. These technologies are being deployed across a plethora of fields ranging from simple devices, such as cell phones, to more complex technologies, such as autonomous vehicles or the diagnosing of diseases. AI is even rearing its advancing technological head into the playing field of banking. It is a constantly evolving technology that many industries are jumping into while others are slowly pushed into in their efforts to thrive. For banks, it’s critical to embrace the advancements of the future but also to consider the security and regulatory requirements and overall risk to the organization and its customers.

What is Artificial Intelligence?

Artificial intelligence is a term that commonly references the various technological capabilities that allow for the analysis of data and the identification of patterns to make decisions and impact an outcome. Some examples of these AI-type activities or branches include machine learning, natural language processing, robotics process automation and speech and object recognition. Machine learning is a branch of AI and computer science that focuses on the use of algorithms and data to imitate human learning patterns, while gradually improving accuracy. With machine learning, the system learns and improves as new data is made available. Another branch of computer science and AI is natural language processing. This branch of AI enables computers to process human language, received through text and spoken words, and to understand the meaning and intent. It basically allows a computer system to understand the semantics of conversational language. The AI branch of robotics process automation, also known as software robotics, is the use of applications and systems to perform human-like tasks. It uses intelligent automation technologies and rule-based software to perform business process activities at a more efficient volume, reducing the need for human resources or involvement in the task. Finally, the AI branch of speech recognition enables a system to identify and process human speech into a written format. Speech recognition may also be referred to as automatic speech recognition, computer speech recognition or speech-to-text. This AI technology is often confused with voice recognition which focuses on identifying an individual user’s voice. However, speech recognition focuses on translating speech from verbal to text. Each of these artificial intelligence branches are utilized throughout financial institutions and countless other industries around the world.

The Benefits of Artificial Intelligence

Artificial intelligence is used in various fields and applications ranging from online shopping, advertising and machine translation enabling cross-language communication, to improving the overall operations and cost efficiency of financial institutions. The use of AI technologies in financial institutions can drastically reduce operational costs while significantly increasing productivity. With its broad range of uses, AI can potentially aid financial institutions in reducing costs associated with products and services, and it can enhance the overall customer experience as it bridges the gap between customer convenience and relationships. AI can benefit a financial institution’s lending process as it can expand credit access, assist in financing decisions, decrease underwriting times and costs and enhance both the borrower and lender experience. AI can be beneficial throughout other areas within financial institutions, such as identity validation and real-time anti-fraud monitoring. The opportunities and benefits when it comes to AI and financial institutions seem to be endless. But there have to be challenges, right?

Artificial Intelligence Challenges

Artificial intelligence isn’t perfect. Like any other enhancing technology, AI comes with its own set of risks and challenges. Some of those risks and challenges include system integration and a gap in skills. With system integration, the data behind AI is equally as critical as the technology itself. In order for the utilization of AI to be beneficial and effective, the data quality and quantity need to be accurate. This involves organizing data and preparing for integration. This means that financial institutions with a core processor will have to coordinate between their core system and their AI technologies. This can often be a complex and costly undertaking and financially burdensome, especially for small financial institutions and community banks. Financial institutions may also run into a more complicated integration process if their core processors and AI solutions vendors are competitors of the same or similar products and services. This challenge often leads to increased fees and costs for integration. Even if financial institutions are able to work out all the kinks related to system integration, there is always the challenge of obtaining expertly trained staff who are knowledgeable in building and deploying AI solutions. With the rapid advancement and use of AI technologies, it has led to a shortage of skilled AI experts in the broader labor force. While this is a challenge that is expected to improve in the future, at present, it leaves financial institutions competing with large tech companies such as Apple or IBM when recruiting for AI talent.

An even more challenging area associated with artificial intelligence and financial institutions is meeting compliance expectations on technologies that are surrounded by so much regulatory uncertainty. Financial institutions are expected to identify and manage all risks related to AI and how it is used within the organization. It’s not enough for financial institutions to simply employ the technologies of AI, but rather they are expected to understand the data or inputs that drive the outcomes. Financial institutions are expected to ensure that all data used within the various branches of AI align with regulatory compliance requirements. For example, if the machine learning branch of AI is used in the decision-making for credit, the bank should understand and be prepared to explain what the contributing factors were that the AI system used to make that decision (i.e., what data was inputted to receive the outcome/decision). It is critical that financial institutions are not only able to understand and explain this process, but also that all the data used within the AI system meet regulatory requirements. This means ensuring that the AI system isn’t using information that may violate consumer or fair lending laws.

Financial institutions that are utilizing AI should have processes in place that allow for the identification of risk, both new and emerging, as well as controls for managing that risk. Because of the rapidly evolving technologies of AI, there is always the challenge of changes in risk level or even unidentified risk developing. Financial institutions need to be prepared to rise to the occasion when it comes to meeting those regulatory and risk challenges, whether that be through an increased frequency of monitoring and reviewing established controls or contracting with external vendors to conduct robust third-party risk management.

The use of AI technologies within financial institutions has captured the interest of regulators and policymakers alike. A couple of key concerns are always the safety and soundness of financial institutions and consumer protections. While AI is constantly growing and advancing, many of the banking laws and regulations currently on the books are still a little behind the times, leaving some areas of regulatory uncertainty. Nevertheless, regulators acknowledge the benefits of AI and support responsible innovations by financial institutions. In 2021, the agencies (Consumer Financial Protection Bureau, Office of the Comptroller of the Currency, Federal Deposit Insurance Corporation, and Federal Reserve Board) issued RFIs (requests for information) on the use of artificial intelligence by financial institutions. In 2022, the OCC (Office of the Comptroller of the Currency) issued supervisory expectations for how banks should manage risks associated with AI. And most recently, in April 2023, a joint statement was issued by the agencies on the enforcement efforts against discrimination and bias in automated systems. The 2023 statement outlines some of the challenges of AI and serves as a reminder that financial institutions must embrace responsible innovation.

Conclusion

For financial institutions to thrive in the industry and remain relevant in the market, they must continue to be forward-thinking and responsible in their innovation efforts. Artificial intelligence is an ever-evolving technology and convenience of the world in which we live. Financial institutions must engage in the balancing act of supporting new and innovative technologies for their consumers while also acknowledging the risks and challenges of such growth. It is imperative to fully understand the technologies that our institutions rely on for its operation and that we remain abreast of any arising issues in the regulatory world. Artificial intelligence is the future, and it’s filled with risks and rewards.

Julia A. Gutierrez serves as Compliance Alliance’s Director of Education, developing curriculum and presentations as well as presenting at various schools and seminars, both live and in a livestream/hybrid format. Julia has over 20 years of financial industry experience with the Compliance Alliance team.

Click the link below to read the joint statement on enforcement efforts against discrimination and bias in automated systems.