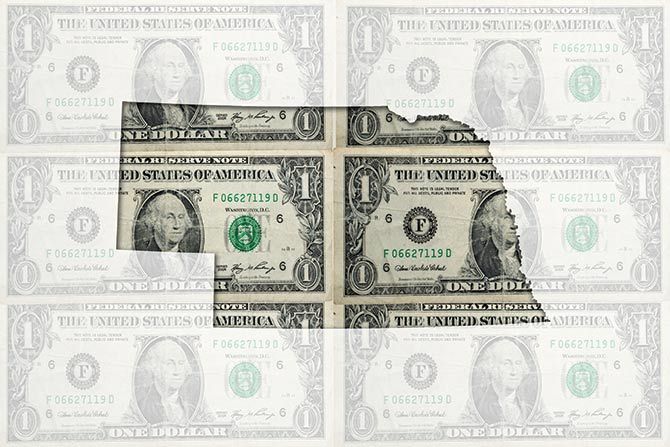

Cryptocurrency: Safe or “Sus”?

In today’s financial regulatory environment, two of the hottest topics are (1) cryptocurrency and (2) cybersecurity. Within the past year, multiple agencies have released various regulations and guidance regarding cryptocurrency, banking, and cybersecurity, both individually and collectively.

Cryptocurrency: Safe or “Sus”? Read More »